The digital health landscape is on a track of rapid growth, ready to reshape healthcare globally. With a market size projected to reach USD 159.34 billion by 2028, the sector’s potential is drawing significant investments from industry giants like Pfizer, Roche, and Johnson & Johnson. In the pursuit of transformative patient care, many pharmaceutical and med-tech leaders are turning to digital health solutions, underlining the pivotal role of technology and artificial intelligence (AI) in unlocking the industry’s full potential.

The Critical Role of Public Procurement Data:

Tendering in healthcare serves as a strategic process for key stakeholders, including governments, health regions, Group Purchasing Organizations (GPOs), public hospitals, and health insurers to ensure public money is spent transparently and effectively. For pharmaceutical and MedTech companies, a substantial portion of annual revenues—30% and 70%, respectively—is tied to these procurement contracts.

Navigating the Data Universe:

Among the uncertainties and data gaps in the digital health landscape, AI and technology emerge as powerful tools to navigate the chaotic data universe. Leveraging the latest technology, including LLMs (Large Language Models) / NLP (Natural Language Processing), enables the screening of millions of tenders daily to extract structured and relevant information. Understanding the spending, buyers, award criteria, competitors and trends serves as a foundation for strategic decision-making, business development, go-to-market strategies, and investment decisions. Technology is the enabler to move from a high level of uncertainty and distraction to much more clarity and focus.

The below data analysis of the European Public Digital Health Market confirms how AI transforms this vast data scene into actionable findings.

Analysis Scope and Key Questions:

Focusing on digital health tenders over the last 18 months, the analysis draws insights from TED, the main procurement website of the European Union, as well as local websites for the UK. Key questions guiding the research include:

- Market Dynamics: Identifying the biggest and most active countries for Digital health Solutions

- Solution Trends: Understanding the demand for specific digital health solutions

- Buyer Profiles: Analyzing key buyers and buyer-types across countries and topics

- Award Criteria and Decision-Making: Uncovering factors influencing decisions in digital health tenders

- Competition: understanding which competitors are most active and successful for which digital solutions and in which countries

Key Findings:

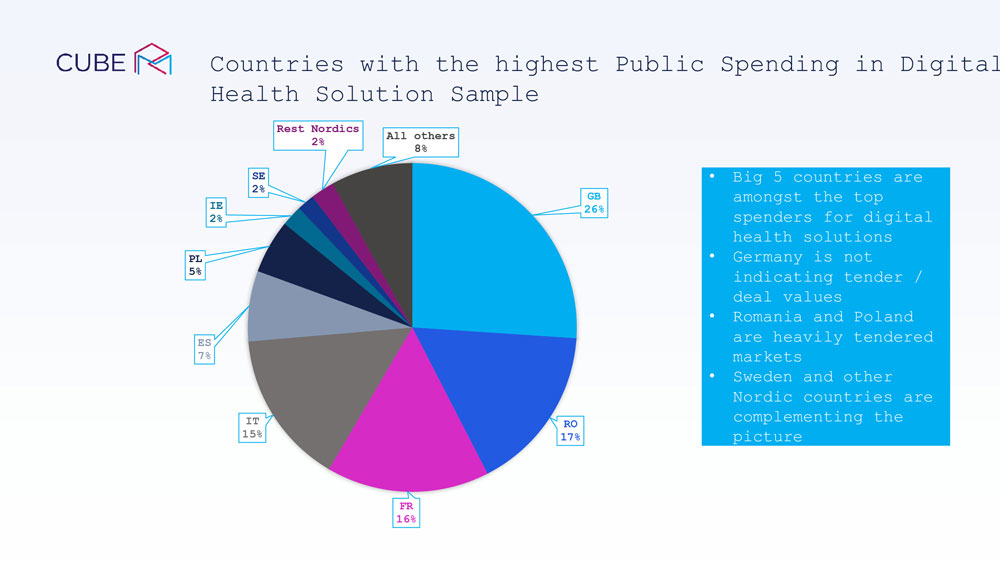

- Countries with Highest Spending: The Big 5 European countries—Germany, France, the United Kingdom, Italy, and Spain—emerge as major contributors to public spending on digital health solutions. Interestingly, Germany does very often not publish specific data on tender values, which is a unique market characteristic that spans across other industries than digital health and skews the data for Germany. Romania and Poland show a very high tender activity, underscoring high demand and interest in digital health solutions. The active involvement of Nordic countries, including Sweden, adds to the overall regional dynamics, emphasizing the significance of digital health solutions across diverse European markets. [graph]

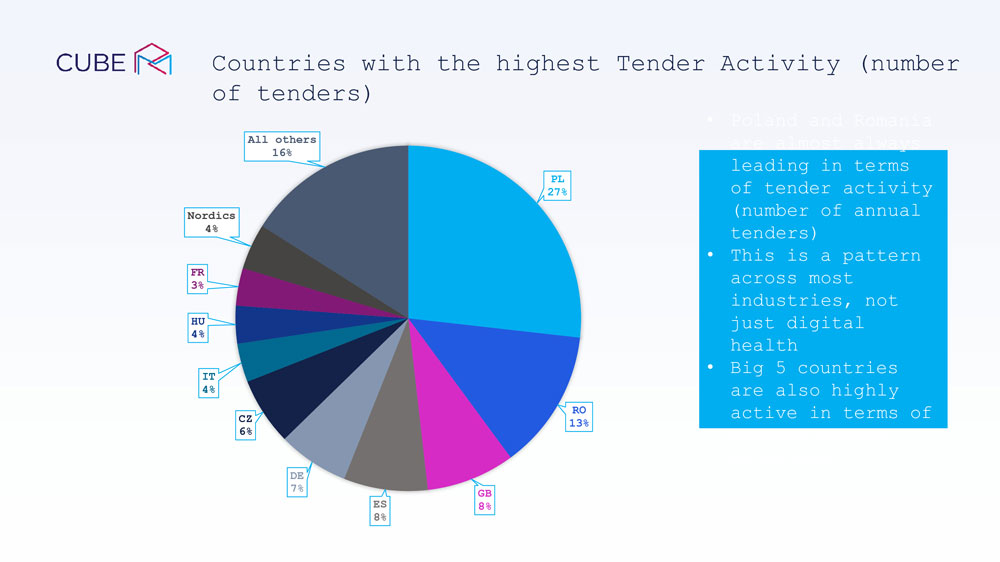

- Countries with Highest Tender Activity: Poland and Romania consistently lead in digital health tender activity, reflecting a broader trend across industries. This pattern, observed in major European economies, particularly the Big 5 countries, emphasizes a robust and widespread engagement in the procurement of digital health solutions. [graph]

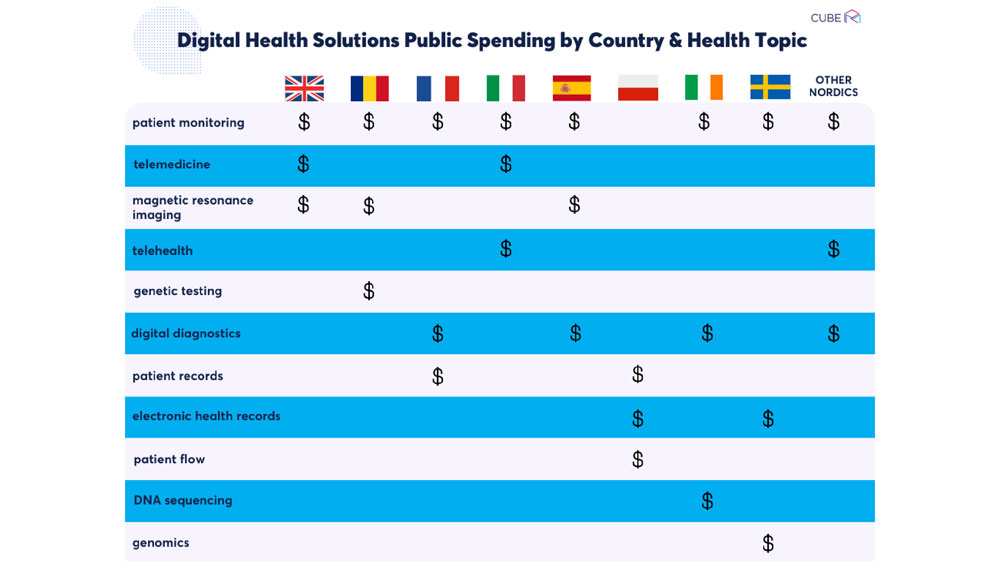

- A breakdown of public spending on various digital health areas across different European countries showed a focus on Patient Monitoring, with substantial investments across European countries. This underscores a shared commitment to technologies facilitating continuous health monitoring. Following closely, Digital Diagnostics emerges as another area witnessing significant investment. Countries such as France, Spain, Ireland & Nordics are demonstrating a clear trend towards advancing diagnostic capabilities through innovations in digital technologies. Question: Do you think there is there any way that spending aligns with the occurrence of certain health conditions or demographics in each country? [graph] – could be, but no way to find out for this report. Maybe for the next one 😉

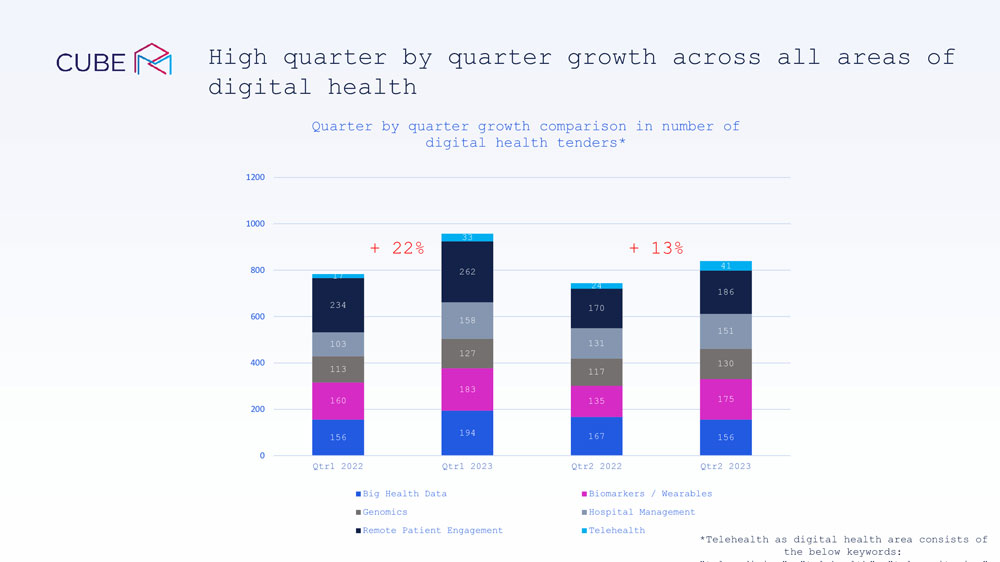

- Quarter-by-Quarter Growth: Digital health experiences remarkable growth, with a +22% surge from Q1 2022 to Q1 2023 and an additional +13% from Q2 2022 to Q2 2023, proving the dynamic and expanding nature of the digital health sector over the analyzed timeframe. The growth trend is visible overall for digital health solutions, but it is also true for most subcategories. [graph]

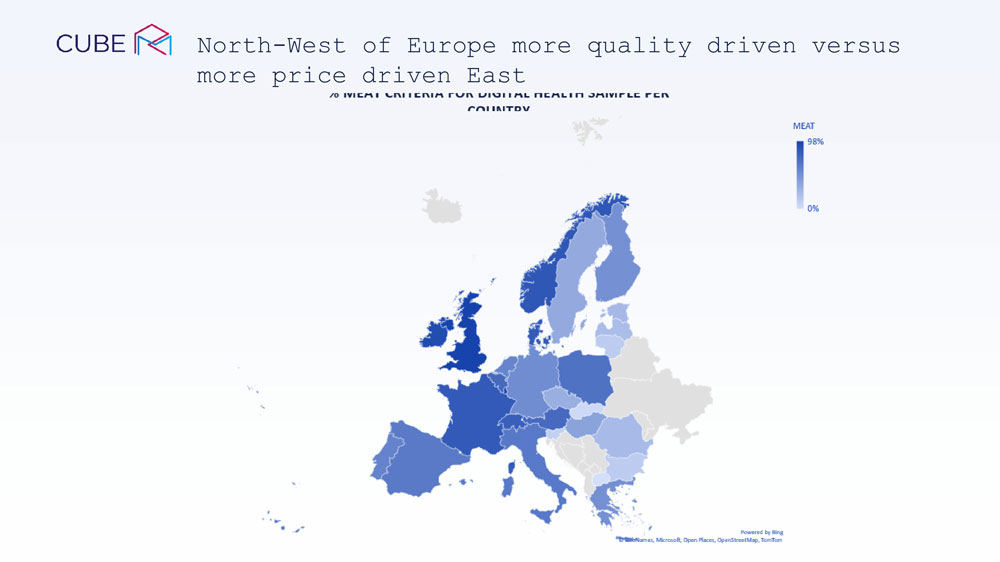

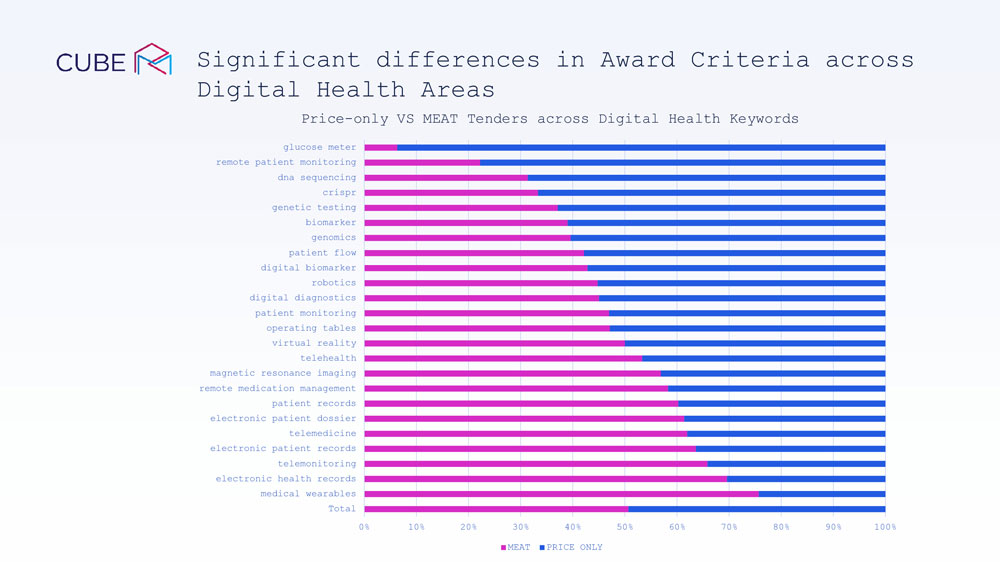

- Award Criteria Comparison – MEAT Vs Price: A divide is observed between quality-driven North-Western countries emphasizing a focus on innovation and efficacy and price-focused Eastern countries, emphasizing cost-focus in their procurement decisions, with significant variations in award criteria across digital health areas. [graph]

A deeper dive into telehealth

The use of the latest technology and data-extraction also allows a deeper examination into specific fields of digital health. For this report we chose the field of telehealth.

Tender Activity & Value:

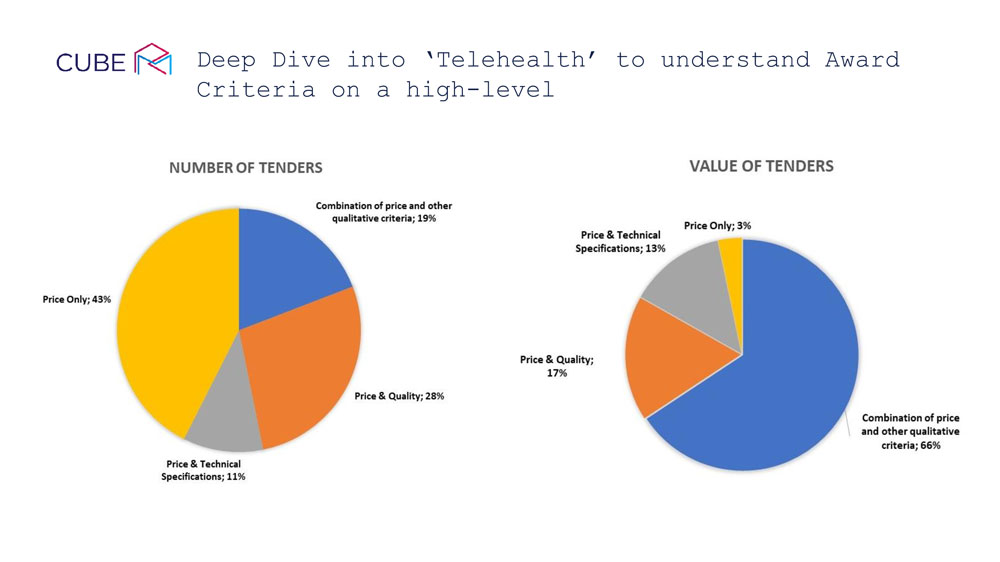

In terms of the number of tenders, a substantial 43% are structured as price-only tenders, indicating a prevalence on cost considerations in the telehealth procurement process.

In terms of tender value, a significant 66% comprise a combination of price and other qualitative criteria. It seems like qualitative aspects play a more substantial role for larger tenders in determining telehealth procurement decisions. [graph]

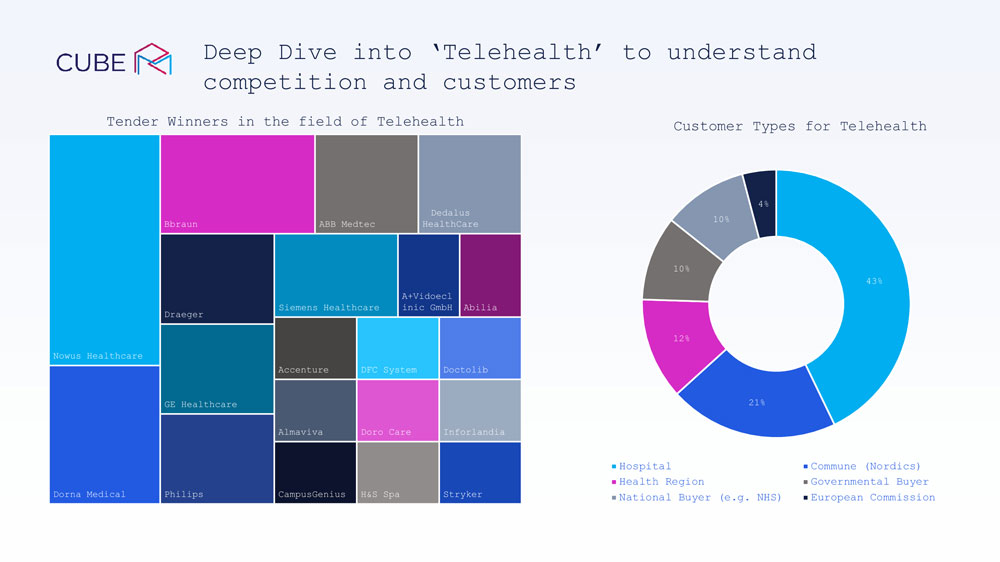

Dominant Players: In the competitive arena of telehealth there is an interesting mix of successful companies which big international players such as B Braun, GE Healthcare, Philips,, or ABB, but also smaller and more local players.

Customer Segmentation: Understanding the customer landscape is pivotal. Our findings revealed that 43% of telehealth customers are hospitals, emphasizing a significant reliance on telehealth solutions within healthcare institutions. Furthermore, a 21% of customers belong to communes in the Nordic region, indicating a distinct geographic concentration of telehealth adoption. [graph]

Embracing Data and Innovation: A Vision for Tomorrow

In the sphere of digital health – with such strong dynamics and uncertainties – technology and AI hold transformative power. From seemingly chaotic data, we extract not just information, but actionable insights that serve as catalysts for change. These insights empower informed decision-making, building of relevant strategies and fit-for-purpose go to market models.